- Currently 73.5% of the population in Vietnam uses a smartphone. The country aims to increase the rate to 85% by the end of 2022.

- In Vietnam, the total transaction value in the Digital Investment segment is projected to reach $2.88 Bn by 2023 which helps the fin-tech companies to grow further in the country.

- The taxi services have been increasing in Vietnam thereby increasing the financing of commercial vehicles, which further increases vehicle purchases in the country.

Digitalization in Vietnam is anticipated: Digitalization in Vietnam is anticipated to rise in the future which will lead to an increase in the Auto Finance market with multiple offline and e-platform players entering the market. Also, the increasing population and growing income levels leading to rising in sales of cars are expected to drive the rise in Auto Outstanding Loans in Vietnam in near future. The Vietnamese Government is planning a motorbike ban after 2030 to reduce traffic congestion and emissions which will increase the selling of more 3W and 4W in the market.

Interested to Know More about this Report- Request for a sample report

Growing Disposable Income and Status: As Vietnam is a middle-income economy, the majority of the people are anticipated to choose a longer loan duration owing to the installments being pocket friendly as monthly payments will be lower. Consumer preferences are more likely to shift to purchasing new vehicles with growing disposable income and status. Also, with the growing population and rapid urbanization, LCVs are probable to have higher sales as LCVs are preferred for high volume low bulk cargo majorly for consumer goods, textiles, and more for short distance haulage.

Visit this Link :- Request for custom report

Block chain-Powered Financing and Artificial Intelligence: In Vietnam digitization has improved significant workflow enhancements, including faster processing, more reliable document handling, and mitigated risk. These models could help keep vehicles affordable as technology features increase manufacturing and maintenance costs. Also, insurers and banks are piloting a variety of block chain-powered financing solutions, and auto captive lenders are serving as test beds for manufacturer block chains which will increase the capacity of the auto finance industry in Vietnam.

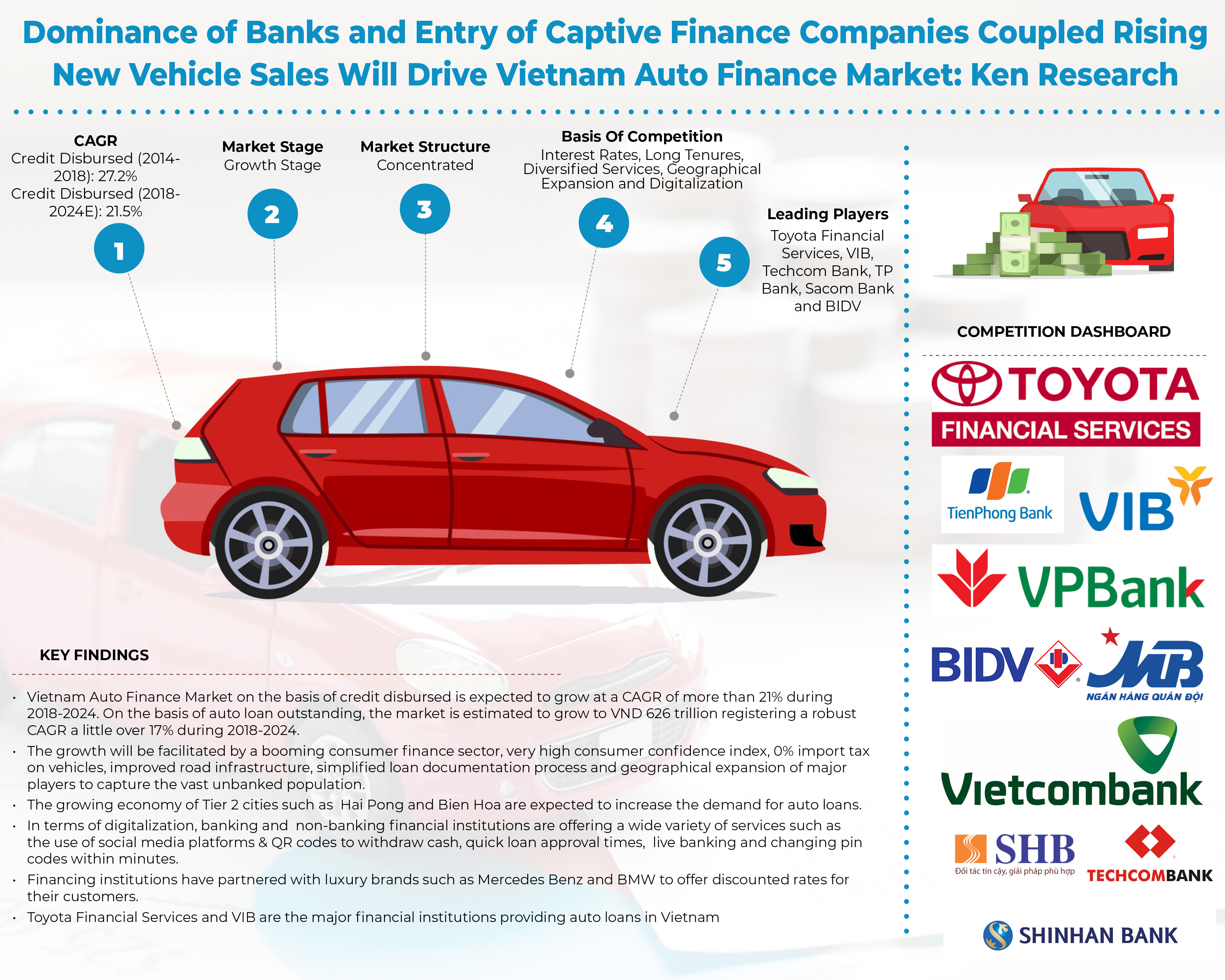

Analysts at Ken Research in their latest publication Vietnam Auto Finance Market Outlook to 2026F- Driven by Digital Penetration and Dominance of Banks along with a Shift in Consumer Preference from 2W to 4W By Ken Research observed that the Auto Finance market is an emergent market in Vietnam at a rebounding stage from the economic crisis after the pandemic. The rising government policies and the increase in banks and financial institutions, entry of captive finance companies along with growing ride-sharing services are expected to contribute to the market growth over the forecast period. The market is expected to grow at a 23.7% CAGR during 2021-2026F owing to the rise in the economy of the country, increasing interest rates, and new government policies.

Key Segments Covered: –

Vietnam Auto Finance:

By Type of Vehicle financed

New

Used

By Tenure:

1 year

2 years

3 years and more

By Type of Motor Vehicle:

Commercial

Passenger

By type of commercial motor Vehicle:

LMV

MCV

HCV

By Type of passenger motor vehicle

2W

3W

4W

By Type of Lender:

Banks

OEMs/Captives

NBFC

By Type of Lending Bank:

Government

Private

To learn more about this report, request a free sample copy

Key Target Audience

Vietnam Auto Industries

Government Bodies & Regulating Authorities

Financial Institutions

Manufacturing Companies

Automobile Distributors

Automobile Dealers and Associations

Investors & Venture Capital Firms

Time Period Captured in the Report:

Historical Year: 2016-2021

Base Year: 2021

Forecast Period: 2022F– 2026F

Major Banks:

Bank for Investment & Development

Vietcom Bank

Sacom Bank

Techcom Bank

Shinhan Bank

Vietnam International Commercial Joint Stock Bank

Vietin Bank

Tien Phong Bank

Woori Bank

Key Topics Covered in the Report

Vietnam Automotive Industry Overview

Vietnam’s Online Auto Finance Market Ecosystem

Business Cycle, Genesis, and Timeline of Vietnam Online Auto Finance Market

Vietnam Auto Finance Value Chain Analysis

Vietnam Auto Finance Market Size, 2021

Vietnam Auto Finance Market Segmentation (by Type of Vehicle Financed, by Type of Motor Vehicle, by Type of Passenger Vehicle, by Type of Commercial Vehicle, by Type of Lenders, by Type of Lending Banks, by Tenure of New and Old Vehicles), 2021

SWOT Analysis of Vietnam Auto Finance Market

Government Regulations of Vietnam Auto Finance Market

Trends and Developments of Vietnam Auto Finance Market

Decision Making Parameter for Selecting Car Loan Vendor

Issues and Challenges in Vietnam Auto Finance Market

Customer Analysis of Auto Finance Market in Vietnam

Competition Overview of Auto Finance Market in Vietnam

Future Outlook and Projections of Auto Finance Market in Vietnam, 2021-2026F

Impact of COVID-19 on Auto Finance Market in Vietnam

Analyst Recommendations for Online Auto- Finance Market in Vietnam

For more insights on the market intelligence, refer to the link below: –

Vietnam Auto Finance Market Analysis

Related Reports by Ken Research: –

Singapore Auto Finance Market Outlook to 2025

Philippines Auto Finance Market Outlook to 2024