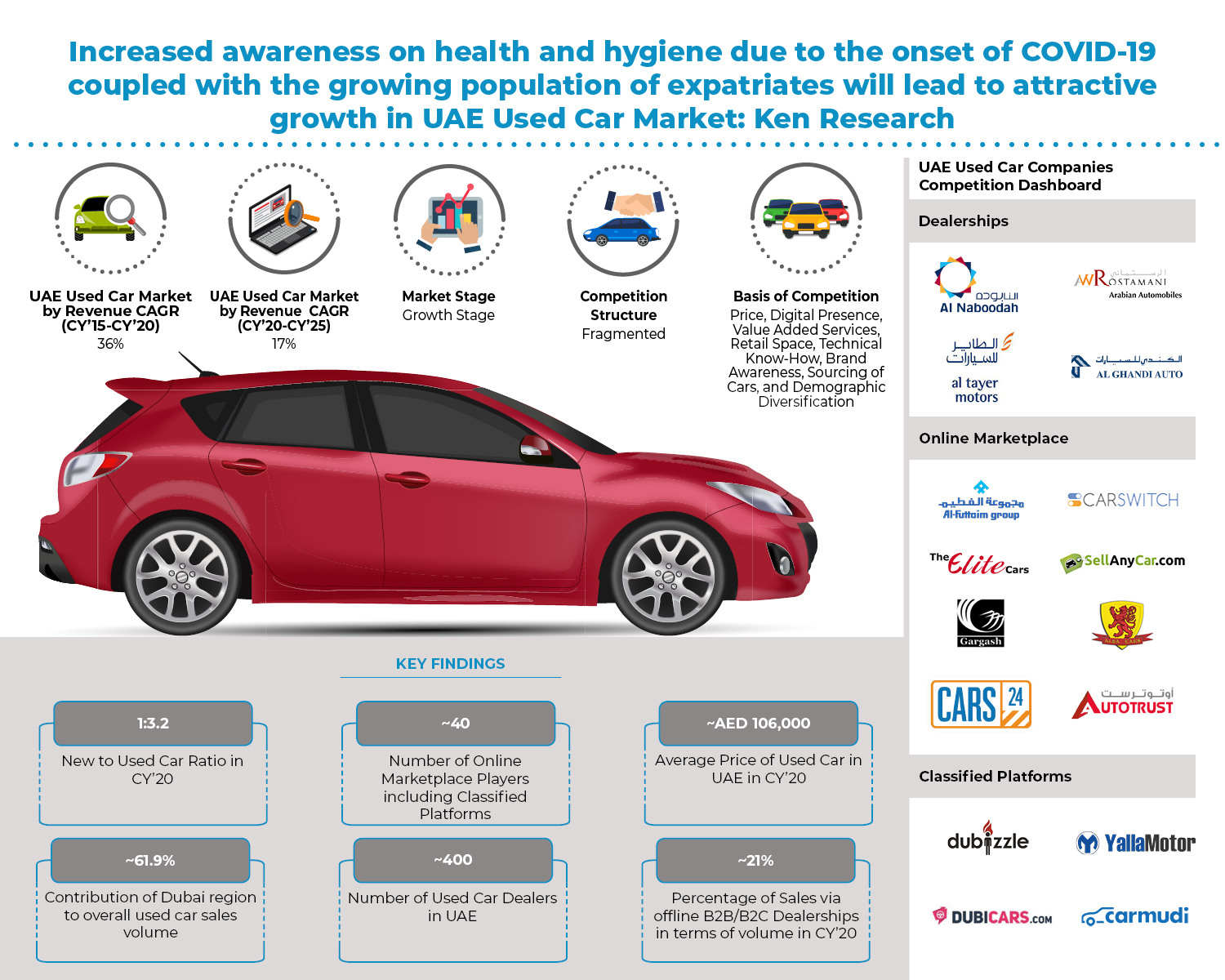

UAE Used Car and Auto Classified Market Outlook to 2025 ( Second Edition ) – Driven by Growing Expat population and increased Awareness on health and hygiene due to covid-19.

UAE used car market revenue stood at AED ~XX Billion in CY’20 and recorded a CAGR of XX% during CY’15-CY’20. The market is fragmented with various players operating in the used car sales channel specifically dealership networks, online marketplace player, and classified platforms. As of 2020, there are more than XX number of dealers in the market and approximately ~XX number of online portals dealing in used cars.

Consumers increasing awareness on health and hygiene due to the onset of COVID-19 has led to the surge in the demand of used cars as they are preferring to avail private transportation medium rather than public transport system. Weaker economic sentiment as a result of COVID-19, initially impacted the market due to supply chain disruption, however it has also fueled the growth prospect of the market as the preference of consumers is shifting towards purchasing affordable pre-owned vehicles rather than spending hefty sums on new cars.

Large number of expatriate population in UAE coupled with shifting preference towards private vehicle ownership would act as major growth drivers for the used car market in coming years. Along with that export prospect of used cars from this region will contribute to the optimistic growth outlook for the market in future.

Competitor’s in UAE Used Car Market competes on various parameters such as price, presence of digital platform, value added services such as warranty & financing options, brand awareness, retail space, and sourcing of cars among others.

Interested to Know More about this Report, Request a Sample Report

Major dealership network present in UAE used car market realm are Al-Naboodah, Arabian Automobiles and Al-Tayer Motors among others. Online marketplace player includes Al-Futtaim, Cars24, Alba Trading etc. On the other hand classified companies include Dubizzle, Dubicars, Yalla Motor and Carmudi among others.

By Type of Car, 2020

The UAE used car market can be segmented on the basis of type of car that consumers prefer. It has been estimated that SUV remains the top choice of customers as of CY’20. Market share, average ticket size and sales volume has been estimated for each segment.

By Type of Manufacturer, 2020

In the used car segment in UAE, Japanese, German, Korean, and American manufactured cars are the most popular among customers. Variety of determinants such as resale value, affordability and condition of the car among others plays a pivotal role in customer’s perception towards these brands.

The report also presents an insight on major automobile companies with sold used cars brand in UAE. Toyota, Lexus and Nissan remains the top used car brand choice among customers.

By Region, 2020

The UAE used car market is further classified on the basis of sales volume in different regions. Used car sales in Dubai has been historically among the highest in comparison to other regions of UAE.

By Sales Chanel on the basis of Sales Volume and Transaction Value, 2020

In recent times as the ecosystem is getting more organized with the integration of number of players, online marketplace and dealership platforms became the major platforms for the sales of used cars rather than conventionally dominant sale of used cars through car repair shops and garages. As of CY’20 it is estimated that online marketplace players contribute up to XX% of the overall sales of used cars in UAE. This is due to their multi-brand option approach which helps the customer in choosing from a wide range of used car brands rather than specific sales of brands which is offered by a dealership platforms.

Request For Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NDc2NTAw

Export and Re-Export of Used and New Cars by Value, 2015-2020

With respect to used cars, the re-export and export are primarily carried out to the Middle East, Africa, Latin American and South East Asia. Majority of the dealers export only left-hand drive used vehicles as UAE has strict laws against steering wheel modifications. This essentially leaves out the Indian sub-continent from the market.

Export industry of used cars in UAE is not a significant as the import and re-export due to the lack of indigenous manufacturers. The size of the export industry of stands at XX billion AED in 2015. This number has grown over the last five years, reaching a value of XX billion AED in 2020.

The total value of re-export of used cars increased from XX billion AED in 2015 to XX billion AED in 2018. However, the value of re-export has decreased in the subsequent years to XX billion AED in 2020. The impact of COVID-19 affected the trading sector as well, which is reflected by the XX% drop in 2020 numbers.

The UAE used car market is fragmented with multiple players operating in the ecosystem, thereby, making the market share of these players well segregated. Dealers, online marketplace and classified platforms are the major sales channel available for a consumer willing to buy a pre-owned vehicle in UAE. These players compete on the basis of price offered, digital presence and value-added services among others. As of CY’20, there are more than XX dealership operating in the ecosystem and ~XX number of online portals dealing in used cars.

The players in the used car market compete on the basis of price, value added services, digital presence, technical know-how, brand awareness, retail space, demographic diversification and sourcing of cars.

For More Information, refer to below link:-

UAE Used Car and Auto Classified Market Growth

Related Reports

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249