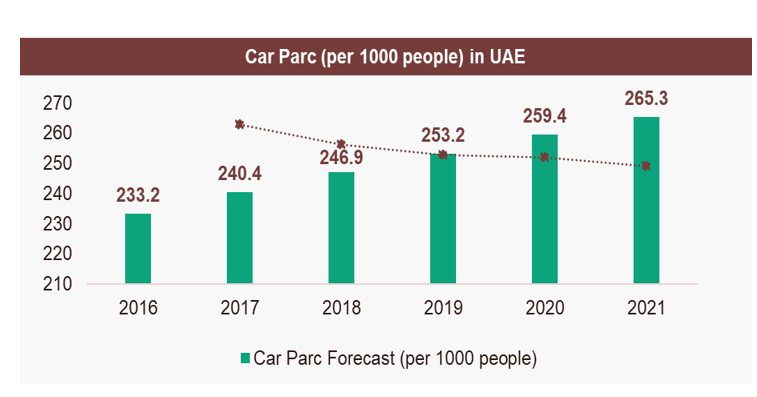

UAE is the second largest automotive market in the Gulf Cooperation Council (GCC) after Saudi Arabia owing to its growing population and high disposable income. The demand for vehicles in the country mainly originates from the construction, infrastructure, logistics, tourism, and public transport sectors have turned the emirate into a major exporter and re-exporter of vehicles. Incentives offered by the government, banks, and car dealers, have also led to the growth in the UAE’s imports of EVs and increased environmental awareness among citizens. Battery Electric Vehicles sales grew at a CAGR of ~49% between 2017 and 2021. Furthermore, the UAE electric vehicle charging market is driven by increasing efforts of the government to reduce the carbon footprint in the country.

Other Challenges in Vehicle Charging Equipment Market

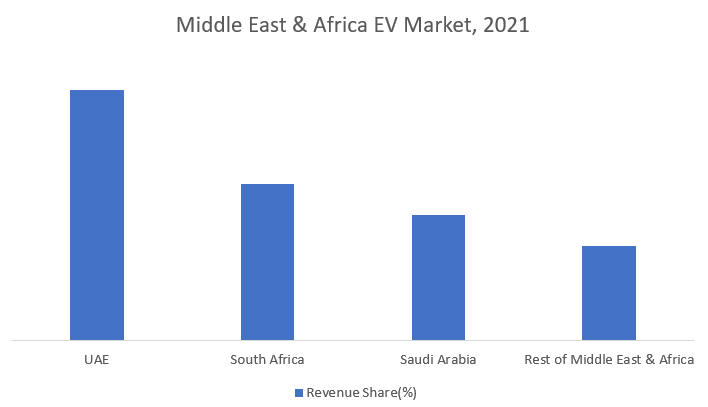

- UAE leads MENA region in the adoption of electric vehicles

UAE leads MENA region in the adoption of electric vehicles due to the decreased cost of EVs and emerging new technologies in the sector. The UAE leads in the adoption of electric vehicles to diversify its economy from oil. As part of Dubai Electricity and Water Authority’s (DEWA) efforts to promote green and sustainable mobility in Dubai, over ~330 Green Charger stations with more than ~530 charging points have been installed across Dubai so far. Furthermore, in Dubai, for instance, endorsed by Dubai’s Roads and Transport Authority (RTA), aims to make public transport emission-free by 2050. It will make Dubai the first City in the MENA region to map out a comprehensive emission-free plan for public transport and related infrastructure. This will boost the adoption of more electric vehicles in the country.

Interested to Know More about this Report, Request for a sample report

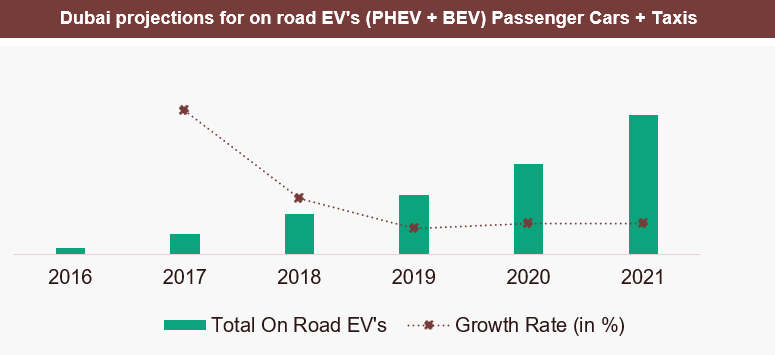

- The Electric Vehicles Market in Dubai has witnessed a growth rate of more than 50% in 2021.

The UAE Electric Vehicle market is currently in its early stage and witnessed certain growth during the period 2018-2021 owing to the Electric Vehicle (EV) Green Charger initiative undertaken by the government of UAE. As of 2021, there are currently 13,000 Electric Vehicles on the roads of Dubai marking a growth rate of more than 50% from 8,500 EVs in 2020. Various initiatives and programs across the UAE are encouraging these shifts towards Green Mobility because the transportation sector plays a vital role in decreasing the carbon footprint. Furthermore, Dubai emirates lead the country with a maximum number of charging stations installed to date and several plans further implementing towards the development of electric mobility.

Visit this Link:- Request for custom report

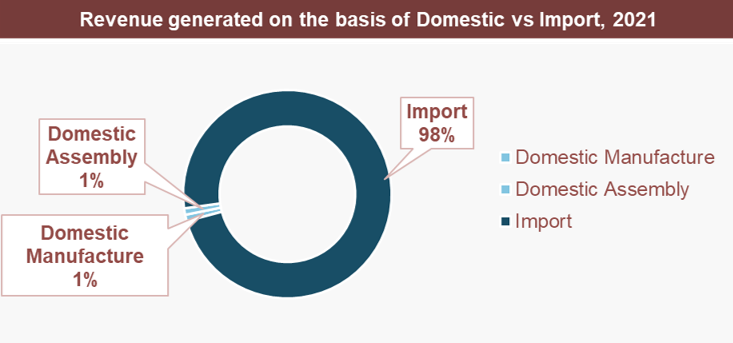

3.The UAE Electric Vehicle Charging Equipment Market relies heavily on Imports accumulating 98% of the revenue share

Imports clearly dominate the EV Charging Equipment market by contributing 98% of the market amounting to USD ~10 Mn in the year 2021. This is due to the fact that UAE relies heavily on the imports of electric vehicles and its parts. Domestic Manufacture and Domestic Assembly has only 1% of the market share each. Promoting itself as a country committed to a low-carbon and sustainable economy, the UAE has an ambitious goal to boost its EV market in the next 20 years.

4. Emergence of technologies like mobile charging, battery cells along with government incentives act as a catalyst for the EV Charging Market in UAE.

In Mobile charging, the chargers themselves are “on the go” and do not require infrastructure expenditures. Moreover, DEWA is providing free charging for non-commercial EV customers registered in the EV Green Charger Initiative. The RTA has also provided electric vehicles incentives, including free parking, reduced electric vehicle registration fees, and exemption from Salik tag fee. Furthermore, technology like Solid State Batteries and Lithium Titanium Oxide Batteries have increased the range of EV’s. They have also reduced their charging time, thereby improving consumer convenience.

Key Segments Covered in UAE EV Charging Equipment Industry

EV Charging Market Size by

- Revenue

- Revenue through new car sales

- Revenue through demand of chargers by type of charging stations

UAE EV Charging Equipment Segmentation By

- Type of Chargers- AC and DC chargers

- Type of Charging- Home Charging, Private Charging, and Public Charging

- Type of Vehicle- 2W and 4W

- Geographic Demand- Dubai, Abu Dhabi, Sharjah, Fujairah, Ajman, Umm Al Quwain, Ras Al Khaimah

- Sales Channels- Direct Sales, Online, and Dealers/ Distributors

- Domestic Manufacture and Import

Product Analysis

- 4W Chargers

Pricing Analysis

- 4W Charger’s pricing

- 2W Charger’s pricing

Key Target Audience

- Electricity Supplier

- EV Manufacturers

- EV Charging Equipment Manufacturers

- EV Charging System Operator

- Demand side Transport Operators

- Government Bodies

Time Period Captured in the Report:

- Historical Period: 2017-2021

- Forecast Period: 2022-2026F

EV Charging Equipment Players in UAE

- ABB

- Schneider Electric

- Siemens

- Yinlong Energy

- Eaton UAE

- Grizzl E

- Elecvlife

Key Topics Covered in the Report

- Overview of EV Market and EV Charging Equipment Market in UAE

- Ecosystem of EV Charging Equipment Market in UAE

- Market Size of EV Charging Equipment Market in UAE (Total EV Charging Equipment Revenue)

- UAE EV Charging Equipment Market Segmentation (By Type of Charging, Type of Chargers, Type of Vehicle, Type of Geography, By Sales Channels)

- Cross comparison of top players in the EV Charging Equipment Market in UAE

- Company Profiles of EV Charger Manufacturers (Overview, Products, Business Streams, Manufacturing Capabilities, Distribution Channels, Recent Projects, Cost Structure, and Awards and Recognitions)

- Growth Drivers and Challenges to UAE EV Charging Equipment Industry

- Industry trends and developments

- SWOT Analysis of EV Market

- Porters Five Forces of the EV Industry in UAE

- Rules and Regulations by Government Bodies

- Future Outlook of Industry

- Case Study (DEWA, EESL, Alfen)