The report titled publication “UAE Experiential Learning Market Outlook to 2025- Concentrated Activity Box and E-Learning Segment Paving Ways for International Players to Expand” provides a comprehensive analysis of the Activity Kit Subscription Industry and K12 E-Learning Industry in UAE. The report provides the industry size basis revenue and a number of subscribers of the activity kit subscription industry in UAE, supply ecosystem analysis, subscriber profile basis various socio-demographic variables, market segmentation, business model analysis, revenue stream analysis competition benchmarking, porter five force analysis, BCG Matrix analysis, COVID impact, future projections and expected trends & challenges.

It also provides the market revenue of the K12 E-Learning Industry, along with revenue by grade and paid user profile by different socio-demographic variables The report talks about new trends witnessed in the industry along with new strategies & future ways forward for K12 E-Learning to move ahead. The report discusses detailed competition analysis in e-learning and concludes with analyst recommendations providing a go-to-model for the industry.

Interested to Know More about this Report, Request a Sample Report

Activity Kit Subscription Industry

Market Overview

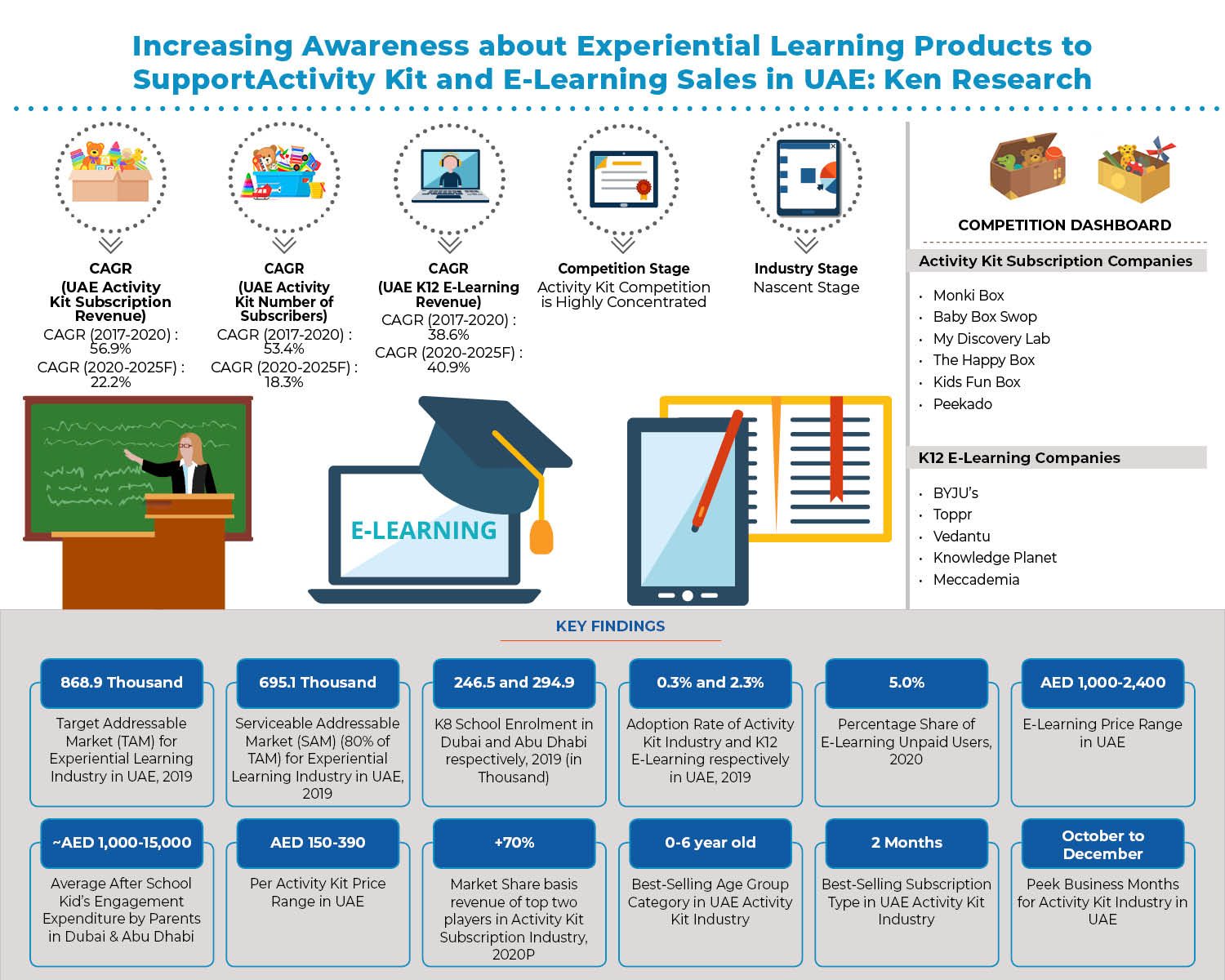

The activity kit industry in UAE is at its nascent stage and has penetrated <0.5% of its target addressable market. The majority of activity kit subscription providers entered the industry post-2017. The industry experienced double-digit revenue and subscriber growth in the review period. Changing lifestyle with an increasing number of dual working parents and increasing screen time of kids, has led to the need for self-engaging, fun, and educational solution such as activity kits.

By Age Group

The majority of activity kit subscribers are from the 0-6 years age group category followed by 7-9 years and 10-14 years. Low academic pressure, traction towards art & craft activities and availability of free time has resulted in 0-6 years accounting for majority of activity kit demand. Companies can penetrate among +6-year-old kids by increasing the difficulty level of the activities and by making curriculum based activity boxes.

By Subscription Type

Majority of subscribers prefer 2 month subscription followed by 6 months, 3 month, 1 month, 12 months and others, however majority of revenue comes from 6 month and 12 month subscribers due to huge difference in subscription price. The concept of activity kit is new in UAE and therefore parents prefer to take a trail subscription of 2 month, 1 month or 3 month. Demand seasonality and kids behavior are the other reason for majority of subscriber selecting 2 month subscription.

By Region

Dubai and Abu Dhabi account for majority of revenue in the activity kit industry followed by Sharjah and other Emirates. These regions have more educated parents who have better awareness and also majority of them are both working couples.

Competition Scenario

The industry is concentrated by 2 of the top players accounting for +70% of the total revenue in 2020. Currently majority of companies are operating as small business with very few of employees and therefore the industry has a lot of scope for foreign and local players with high financial backing to expand in the country. Existing companies are developing art & craft and STEM themed activities. The companies in UAE have explored varied revenue streams such as subscription, one-off sales, gift cards, festive boxes, travel boxes, marketing and STEM classes.

Future Strategies-The Way Forward

The industry experienced a drastic downfall in 2020 due to slowdown in business activities. However, the industry is expected to recover by early 2022 and it is expected to grow at double digit CAGR in the next 5 years. Companies are expected to expand by collaborating with schools and by introducing curriculum based activity boxes. The competition from foreign players’ especially Indian players such as Flinto, Magic Crate and Xplorabox will increase.

K12 E-Learning Market in UAE

Industry Overview

The K12 E-Learning industry is as its growth stage in UAE. The industry in UAE has gained pace after 2017 and is becoming famous majorly among the Expats. The industry revenue is growing with a double digit CAGR. High average household income, limited number of offline options, growing awareness about experiential learning increasing fee of private tutors and changing family set-up has lead to increasing number of paid e-learning users.

By Grade

Majority of revenue comes from Grade 9-12 users followed by 6-8 grades, 4-5 grade and UKG-Grade 3. Increasing pressure of board exams and growing pressure to stand out in the future has led to increase in demand in Grade 9-12 category. BYJU’s is one of the very few companies providing experiential e-learning for UKG to Grade 3 kids

Competition Scenario

The industry is concentrated by Indian E-learning companies such as BYJU’s, Vedantu and Toppr. Many offline training institute entered the e-learning segment due to COVID in 2020. The competition in the industry is fierce, with companies competing on the basis of basis of curriculum, target audience, technological stack, school partners and brand value.

Future Strategies-The Way Forward

The industry experienced a slight drop in revenue in 2020 due to lack of possibility of door-to-door consulting and also because many of the expats returned to their home countries. However, the industry is still expected to grow with a double digit CAGR by introducing Arabic tutoring, by sales and marketing expansion by Indian players such as Toppr & Vedantu, introduction of coding courses and by growing B2B partnerships.

Key Segments Covered: –

K8 Activity Kit Industry Revenue By Age Group

0-3 years

4-6 years

7-9 years

10-14 years

K8 Activity Kit Industry Revenue By Subscription Type

1 Month

2 Month

3 Months

6 Months

12 Months

Others (4 Month, 8 Month & 9 Month)

K8 Activity Kit Industry Revenue By Emirate

Dubai

Abu Dhabi

Sharjah

Others (Ajman, Umm Al Quwain, Ras Al Khaimah and Al Fujairah)

K12 E-Learning Industry Revenue By Grade

UKG- Grade 3

Grade 4-5

Grade 6-8

Grade 9-12

Key Target Audience

E-Learning Companies

Activity Kit Companies

Toy Companies

Schools

Pre-Schools

Government Authority

Time Period Captured in the Report:

Historical Period: 2017-2020

Forecast Period: 2020-2025

Companies Mentioned:

UAE Activity Kit Subscription Competitive Ecosystem

Monki Box

Baby Box Swop

My Discovery Lab

The Happy Box

Kids Fun Box

Peekado

UAE K12 E-Learning Competitive Ecosystem

BYJU’s

Toppr

Vedantu

Knowledge Planet

Meccademia

Key Topics Covered in the Report: –

Target Addressable Audience, Serviceable Addressable Market and Share of Market for Experiential Learning

Snapshot of Dubai Education Industry

Snapshot of Abu Dhabi Education Industry

Existing Gaps in Experiential Learning Industry

Supply Ecosystem

Business Model Analysis in Activity Kit Industry

Revenue Streams in Activity Kit Industry

Organizational Structure of Activity Kit Company

Case Studies of Offline Players Providing Experiential Learning in UAE such as Sylvan Learning Dubai and Metamindz

Porter Five Force Analysis for Activity Kit Industry and E-Learning Industry

BCG Matrix for Activity Kit Industry

Impact of COVID

Demand Side Survey Analysis

Analyst Recommendation

GTM Strategy for a New Entrant (Market Potential, Target Audience Bracketing, Product Positioning, Product Pricing Strategy, Marketing and Customer Acquisition Strategy and Potential Risks)

For More Information on the research report, refer to the below link: –

Future of UAE Experiential Learning Market

Related Reports by Ken Research: –

Contact Us: –

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249